Wastewater Treatment Solutions for Urban Communities in Pakistan

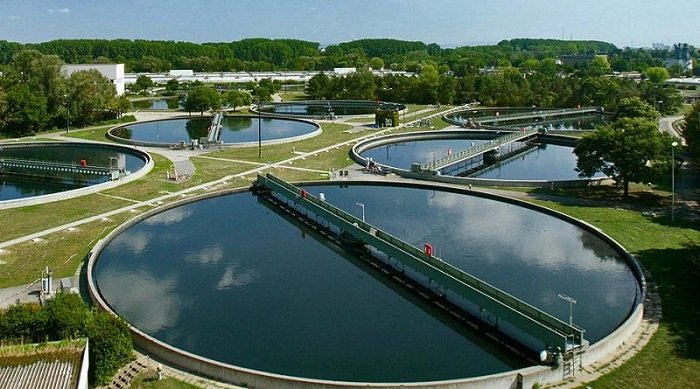

ACCO Wastewater Treatment Solutions for Urban Communities in Pakistan In a rapidly urbanizing world, wastewater management has become a critical concern, especially in densely populated areas like urban communities in Pakistan. The unchecked discharge of untreated wastewater poses significant environmental and

Sewage Treatment Plant For Housing Society Pakistan

ACCO Sewage Treatment Plant For Housing Society Pakistan In a world where environmental concerns are increasingly becoming a priority, the implementation of efficient sewage treatment systems is crucial. In Pakistan, the ACCO Sewage Treatment Plant has emerged as a pioneering solution

Managing wastewater networks: from collection to treatment Pakistan

ACCO Managing Wastewater Networks: From Collection to Treatment In the modern world, managing wastewater networks has become an imperative task to ensure the well-being of both the environment and society. Wastewater, if not handled efficiently, can pose significant health and environmental

Warehouse & Storage Buildings Design and Construction

/*! elementor - v3.14.0 - 18-06-2023 */ .elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=".svg"]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block} ACCO Warehouse & Storage Buildings Design and Construction In today's fast-paced business landscape, the need for efficient and well-designed warehouse and storage facilities is greater than ever before. ACCO, a leading

What is Warehouse Construction Costs in Pakistan Compare to the World

/*! elementor-pro - v3.7.2 - 15-06-2022 */ .elementor-gallery__container{min-height:1px}.elementor-gallery-item{position:relative;overflow:hidden;display:block;text-decoration:none;border:solid var(--image-border-width) var(--image-border-color);border-radius:var(--image-border-radius)}.elementor-gallery-item__content,.elementor-gallery-item__overlay{height:100%;width:100%;position:absolute;top:0;left:0}.elementor-gallery-item__overlay{mix-blend-mode:var(--overlay-mix-blend-mode);-webkit-transition-duration:var(--overlay-transition-duration);-o-transition-duration:var(--overlay-transition-duration);transition-duration:var(--overlay-transition-duration);-webkit-transition-property:mix-blend-mode,opacity,background-color,-webkit-transform;transition-property:mix-blend-mode,opacity,background-color,-webkit-transform;-o-transition-property:mix-blend-mode,transform,opacity,background-color;transition-property:mix-blend-mode,transform,opacity,background-color;transition-property:mix-blend-mode,transform,opacity,background-color,-webkit-transform}.elementor-gallery-item__image.e-gallery-image{-webkit-transition-duration:var(--image-transition-duration);-o-transition-duration:var(--image-transition-duration);transition-duration:var(--image-transition-duration);-webkit-transition-property:-webkit-filter,-webkit-transform;transition-property:-webkit-filter,-webkit-transform;-o-transition-property:filter,transform;transition-property:filter,transform;transition-property:filter,transform,-webkit-filter,-webkit-transform}.elementor-gallery-item__content{display:-webkit-box;display:-ms-flexbox;display:flex;-webkit-box-orient:vertical;-webkit-box-direction:normal;-ms-flex-direction:column;flex-direction:column;-webkit-box-pack:var(--content-justify-content,center);-ms-flex-pack:var(--content-justify-content,center);justify-content:var(--content-justify-content,center);-webkit-box-align:center;-ms-flex-align:center;align-items:center;text-align:var(--content-text-align);padding:var(--content-padding)}.elementor-gallery-item__content>div{-webkit-transition-duration:var(--content-transition-duration);-o-transition-duration:var(--content-transition-duration);transition-duration:var(--content-transition-duration)}.elementor-gallery-item__content.elementor-gallery--sequenced-animation>div:nth-child(2){-webkit-transition-delay:calc((var(--content-transition-delay) / 3));-o-transition-delay:calc((var(--content-transition-delay) / 3));transition-delay:calc((var(--content-transition-delay) / 3))}.elementor-gallery-item__content.elementor-gallery--sequenced-animation>div:nth-child(3){-webkit-transition-delay:calc((var(--content-transition-delay) / 3) * 2);-o-transition-delay:calc((var(--content-transition-delay) / 3) * 2);transition-delay:calc((var(--content-transition-delay) / 3) * 2)}.elementor-gallery-item__content.elementor-gallery--sequenced-animation>div:nth-child(4){-webkit-transition-delay:calc((var(--content-transition-delay) / 3) * 3);-o-transition-delay:calc((var(--content-transition-delay) / 3) * 3);transition-delay:calc((var(--content-transition-delay) / 3) * 3)}.elementor-gallery-item__description{color:var(--description-text-color,#fff);width:100%}.elementor-gallery-item__title{color:var(--title-text-color,#fff);font-weight:700;width:100%}.elementor-gallery__titles-container{display:-webkit-box;display:-ms-flexbox;display:flex;-ms-flex-wrap:wrap;flex-wrap:wrap;-webkit-box-pack:var(--titles-container-justify-content,center);-ms-flex-pack:var(--titles-container-justify-content,center);justify-content:var(--titles-container-justify-content,center);margin-bottom:20px}.elementor-gallery__titles-container:not(.e--pointer-framed) .elementor-item:after,.elementor-gallery__titles-container:not(.e--pointer-framed)

5 Marla House Construction Cost Lahore Pakistan

5 Marla House Construction Cost in Lahore, Pakistan Introduction When it comes to building your dream home, one of the first questions that often comes to mind is, "How much will it cost?" This is a crucial consideration, especially if you're planning

Industrial Construction Services

Outline of the ArticleIntroduction to ACCO Industrial Construction ServicesWhat Sets ACCO Industrial Construction Services Apart?Expertise in Industrial ConstructionCutting-Edge Technology IntegrationCommitment to Safety StandardsServices Offered by ACCO Industrial Construction ServicesFacility Construction and ExpansionEquipment InstallationMaintenance ServicesIndustries Served by ACCO Industrial Construction ServicesManufacturingEnergyChemical

“Industrial Construction Services Lahore, Fasilabad, Karachi Pakistan”

Industrial Construction Services Pakistan Comprehensive Guide to ACCO Industrial Construction Services in Pakistan SEO Meta Description: Explore the range of ACCO Industrial Construction Services in Pakistan. From state-of-the-art facilities to expert project management, ACCO offers a comprehensive solution for industrial construction needs. Introduction Welcome

Affordable Hospital Construction Services in Lahore | Turnkey Healthcare Projects by ACCO

🏥 Affordable Hospital Construction Services in Lahore | Turnkey Healthcare Projects by ACCO Looking to build a hospital in Lahore with affordable costs and world-class quality?At ACCO Construction, we specialize in turnkey healthcare projects, offering complete design, planning, and construction solutions

Road Construction Company in Lahore, Pakistan

ACCO NO 1 Road Construction Company in Lahore, PakistanIntroductionWhen it comes to road construction in Lahore, Pakistan, ACCO NO 1 stands out as the leading company in the industry. With its commitment to excellence, quality workmanship, and timely project delivery,